INDIA BUDGET 2023-24: ANALYSIS

Budget basically consists of two things:

1. Income - called 'receipts'

2. Spending - called 'expenditure'

And both these things in turn consist of two more things: 'revenue' and 'capital'.

So the two types of receipts (income) are:

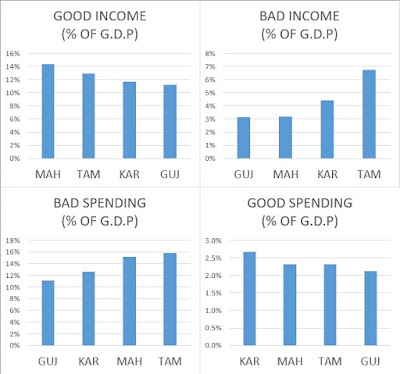

1. Revenue receipts - Mainly taxes (good)

2. Capital receipts - Mainly loans (bad - because we must repay them, with interest)

And the two types of expenditure (spending) are:

1. Revenue expenditure - Mainly salaries of govt workers (bad)

2. Capital expenditure - Mainly assets like infrastructure (good - because they make the economy more productive)

Thus totally we have 2 x 2 = 4 things. Table 1 shows the comparison of these four numbers between this financial year (2022-23) and the Budget - which is for the next financial year (2023-24). The last column shows the % increases in bold:

1. Revenue receipts (good income) is going up by 11.9% - while capital receipts (bad income) is going up by only 1.6%.

2. Capital expenditure (good spending) is going up by 30.5% - while revenue expenditure (bad spending) is going up by only 1.2%.

These numbers look very positive. But how realistic are they? Table 2 shows the similar comparison of these four numbers between this financial year (2022-23) and the last financial year (2021-22).

Finally Table 3 shows the comparison between these two sets of increases (ie, Table 1 vs Table 2). The two critical rows are shown in red:

1. This financial year, revenue receipts (good income) has gone up by only 8.3% - while the Budget says it will go up by 11.9% the next financial year.

2. This financial year, revenue expenditure (bad spending) has gone up by 8.1% - while the Budget says it will go up by only 1.2% the next financial year.

So going by this financial year's actual numbers, the Budget seems to be:

1. Over-estimating the increase in revenue receipts (good income)

2. Under-estimating the increase in revenue expenditure (bad spending)

If these two numbers go wrong, then the government will have to bridge the increased gap between total receipts and total expenditure by increasing its capital receipts (bad income).

Thus at first sight, the Budget seems to be very ambitious. Let us see to what extent the government succeeds in achieving its ambitions . . .